Managing Organization Settings

This guide explains how to configure organizational settings in Funderr. These settings are essential for defining your organization's structure, policies, and operational parameters.

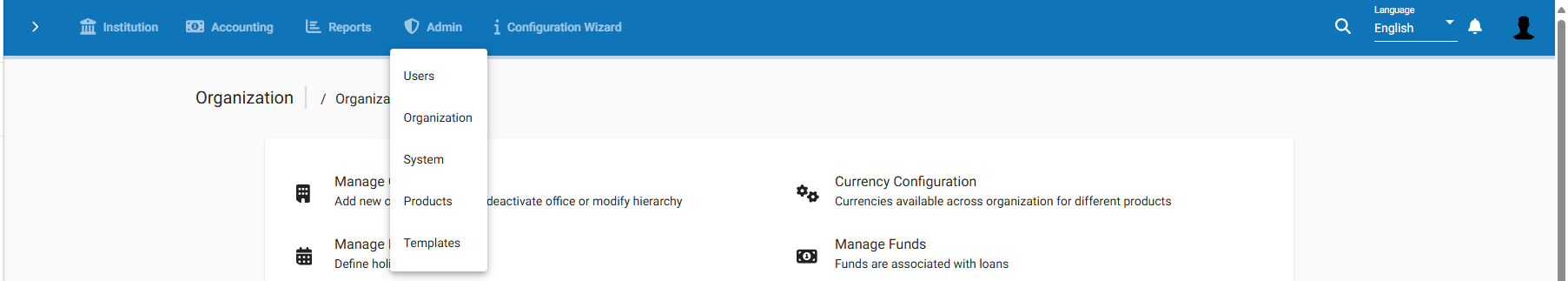

1. Accessing the Organization Settings Screen

To access the Organization Settings screen, follow these steps:

1.1 Select Admin: Click "Admin" from the main menu.

1.2 Click Organization: Click on "Organization" from the admin dropdown menu.

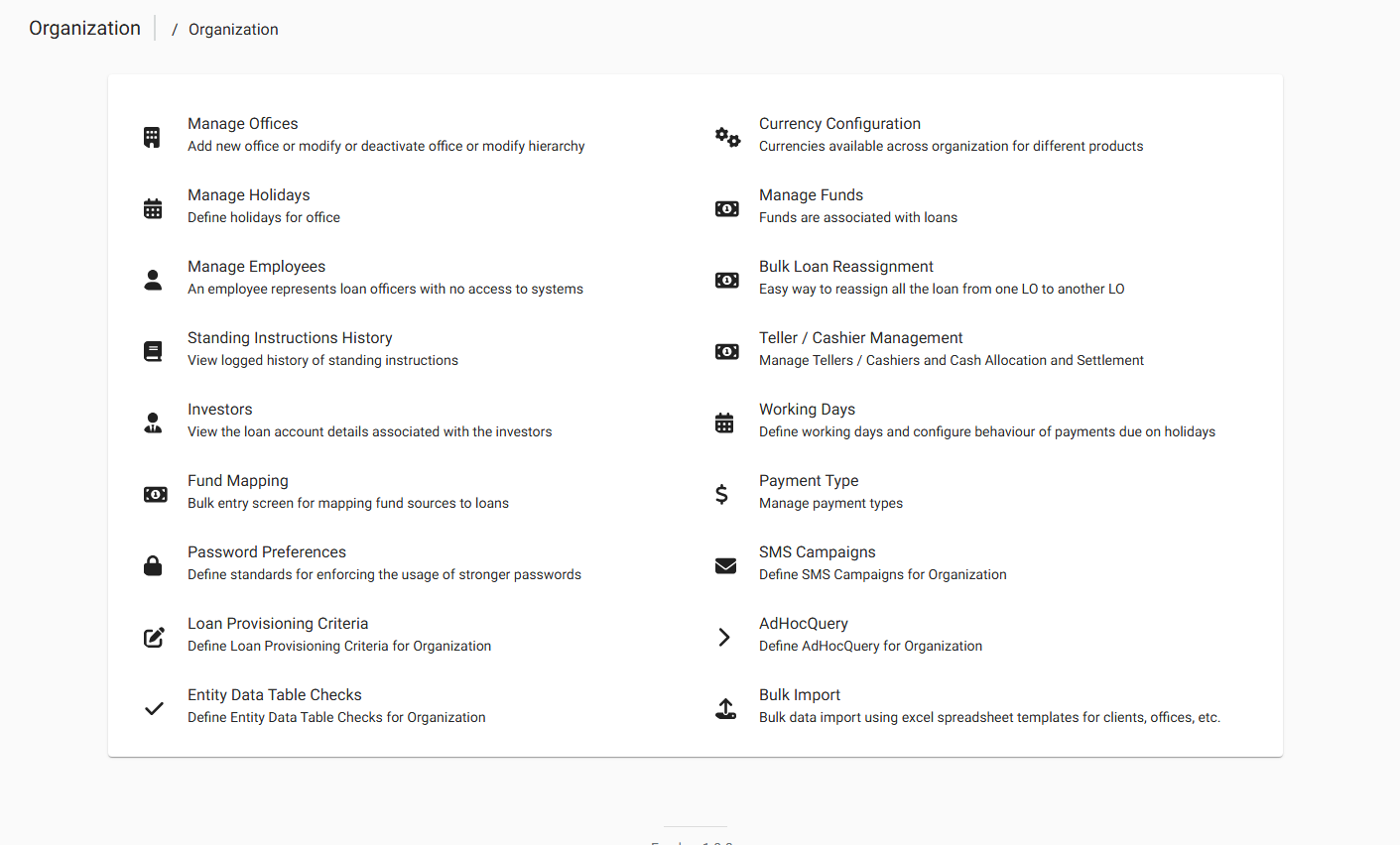

2. Available Organization Settings

The following organizational settings can be configured in Funderr:

2.1 Manage Offices: Add, modify, or deactivate offices and define office hierarchy. Offices represent physical locations or operational units.

To manage offices, navigate to Manage Offices.

2.2 Currency Configuration: Configure currencies available across the organization for different products. This is crucial for managing transactions in different currencies.

To set currency setting, navigate to Currency Configuration.

2.3 Manage Holidays: Define holidays for the office. Holidays impact loan repayment schedules and other date-sensitive calculations.

To manage holidays, navigate to Manage Holidays.

2.4 Manage Funds: Funds are associated with loans. Manage the sources of funding for your lending operations.

To manage funds, navigate to Manage Funds.

2.5 Manage Employees: An employee represents loan officers with no access to systems.

To manage employees, navigate to Manage Employees.

2.6 Bulk Loan Reassignment: Easily reassign all loans from one Loan Officer (LO) to another LO.

To do a bulk loan assignment, navigate to Bulk Loan Reassignment.

2.7 Standing Instructions History: View logged history of standing instructions. This provides a record of automated financial instructions.

To view instructions, navigate to Standing Instructions History.

2.8 Teller / Cashier Management: Manage Tellers / Cashiers and Cash Allocation and Settlement. This is important for managing cash handling processes.

To manager tells, navigate to Teller / Cashier Management.

2.9 Investors: View the loan account details associated with the investors.

To find investors, navigate to Investors.

2.10 Working Days: Define working days and configure the behavior of payments due on holidays. This affects loan repayment schedules.

To manage working days, navigate to Working Days.

2.11 Fund Mapping: Bulk entry screen for mapping fund sources to loans. This ensures correct allocation of funding.

To map a found, navigate to Fund Mapping.

2.12 Payment Type: Manage payment types. Define the different methods of payment accepted (e.g., cash, mobile money).

To manage the payment types, navigate to Payment Type.

2.13 Password Preferences: Define standards for enforcing the usage of stronger passwords. This is a crucial security measure.

To manager password, navigate to Password Preferences.

2.14 SMS Campaigns: Define SMS Campaigns for the Organization. Configure SMS notifications for various events.

To configure SMS campaign, navigate to SMS Campaigns.

2.15 Loan Provisioning Criteria: Define Loan Provisioning Criteria for the Organization.

To configure loan provisioning criteria, navigate to Loan Provisioning Criteria.

2.16 AdHocQuery: Define AdHocQuery for the Organization.

To define the adhoc query, navigate to AdHocQuery.

2.17 Entity Data Table Checks: Define Entity Data Table Checks for Organization.

To make table checks, navigate to Entity Data Table Checks.

2.18 Bulk Import: Bulk data import using Excel spreadsheet templates for clients, offices, etc.

To bulk import, navigate to Bulk Import.